Allied Bank Ensures Secure SWIFT Transfers for International Payments

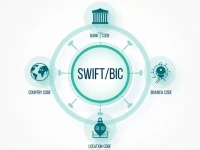

This article provides a detailed explanation of the SWIFT/BIC code ABPAPKKAIBG for ALLIED BANK LIMITED. It discusses the components of the code, how to accurately use it for international remittances, and highlights important verification steps, aiming to offer readers safe and efficient guidelines for their remittance transactions.